Top 10 Financial and Tax Tips for Graduate Students

- August 13, 2024

- Posted by: CKH Group

- Categories: Financial Tips, Tax tips

Tips for graduate students: A 2024 Guide to Post-Graduation Success

Graduating from college marks the beginning of an exciting new chapter in life. The transition from student to professional often involves relocating, starting a new job, and finding the perfect place to live. Amidst these changes, one critical aspect that shouldn’t be overlooked is managing your finances, particularly understanding and optimizing your tax situation. This guide outlines ten essential financial steps and tax tips to help you navigate post-graduation life with confidence and set yourself up for long-term success.

1. Understand Dependency Rules

If you’ve recently graduated, your parents may still be able to claim you as a dependent on their tax return. The IRS has specific criteria for determining dependency status:

- You must be under 24 years old by the end of the calendar year.

- You must have been enrolled as a full-time student for at least five months of the year.

- You must have lived with your parents for more than half of the calendar year (time spent away from home for school doesn’t disqualify you).

- Your parents must have provided more than half of your financial support during the year.

Meeting all these requirements means your parents can still claim you as a dependent, allowing them to benefit from dependency exemptions and education credits. This could provide significant financial relief for your family, so it’s important to communicate with your parents about your status.

2. Maximize the Lifetime Learning Credit

Even after graduation, you might pursue additional education to advance your career. The Lifetime Learning Credit is a valuable tax credit that applies to expenses incurred when taking higher education courses, including non-degree courses aimed at improving job skills. For the 2024 tax year, the credit is 20% of up to $10,000 in qualified education expenses, with a maximum annual credit of $2,000 per tax return. This credit isn’t refundable, meaning it can reduce your tax bill to zero, but it won’t generate a refund. However, there’s no limit on the number of years you can claim this credit, making it a useful tool for ongoing education throughout your career.

3. Deduct Your Student Loan Interest

For many graduates, student loans are a significant financial burden. The good news is that you can deduct up to $2,500 of student loan interest each year, in addition to the standard deduction ($13,850 for single filers in the 2024 tax year). However, this deduction is gradually reduced and eventually eliminated if your modified adjusted gross income (MAGI) exceeds $75,000. Keeping track of your loan payments and ensuring you qualify for this deduction can ease the financial strain of repaying student loans.

4. Get Your W-4 Right

Starting a new job typically involves filling out Form W-4, which determines how much income tax your employer will withhold from your paycheck. The goal is to have the correct amount withheld so you don’t owe taxes at the end of the year. If your withholdings are too low, you may need to pay estimated taxes each quarter to avoid a surprise tax bill on Tax Day. Understanding your W-4 and adjusting it as needed is crucial for managing your tax liability effectively.

5. Continue Education While Working

If you’re working while pursuing further education, it’s important to know that work-related education costs might qualify for tax benefits. These expenses can be excluded from your income if they’re part of an employer-provided Educational Assistance Program (EAP). Taking advantage of these programs can reduce your taxable income and make it easier to manage both work and study.

6. Keep Track of Side Gig Income

Many students and recent graduates take on side gigs or freelance work. If you’re self-employed, it’s essential to keep meticulous records of your income and expenses, as some expenses may be deductible. However, being self-employed also means you’re responsible for paying estimated taxes and self-employment taxes. Properly managing these obligations can prevent any unpleasant surprises at tax time.

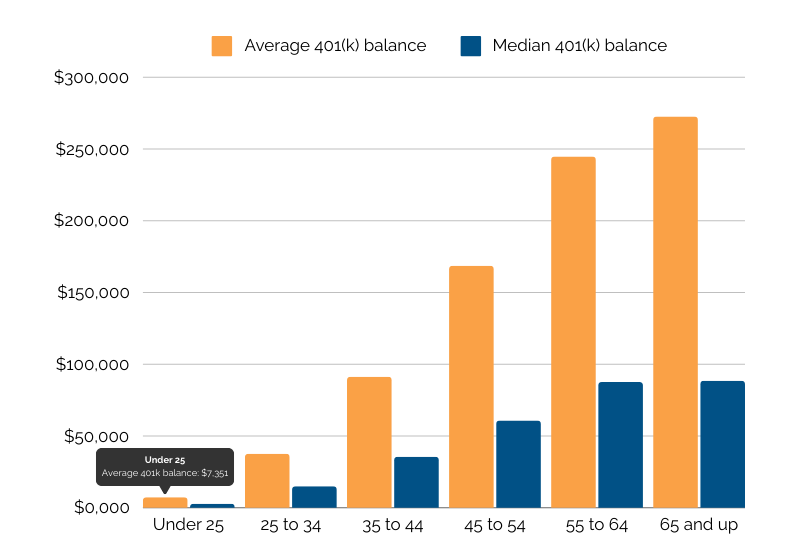

7. Start Saving with a 401(k)

Starting your career often means you’re financially strapped, but contributing to a 401(k) as soon as possible can significantly improve your long-term financial health. If your employer offers a matching contribution, aim to contribute enough to receive the full match—this is essentially free money. If that’s not feasible, consider starting with a traditional 401(k) contribution to begin building your retirement savings.

8. Build an Emergency Fund

While contributing to your 401(k) is important, don’t overlook the need for an emergency fund. Aim to save three to six months’ worth of living expenses in a separate, easily accessible savings account. This fund can be a financial lifesaver in case of unexpected expenses like medical bills, car repairs, or job loss. Starting to build this fund early in your career will provide you with a safety net that can help you avoid debt in challenging times.

9. Consider a Health Savings Account (HSA)

If your new job offers a high-deductible health plan (HDHP), you may be eligible to open a Health Savings Account (HSA). An HSA allows you to contribute pre-tax dollars to pay for qualified medical expenses. For 2024, you can contribute up to $3,850 for individual coverage and $7,750 for family coverage. Additionally, if you’re 55 or older, you can contribute an extra $1,000 as a catch-up contribution. The funds in an HSA roll over year to year, and withdrawals for qualified medical expenses are tax-free, making it a valuable tool for managing healthcare costs.

10. Consult a Professional

If this is your first time filing taxes independently, consulting a Certified Public Accountant (CPA) can provide valuable guidance. A CPA can help you identify tax breaks, keep you informed of changing tax laws, and ensure your tax return is accurate. Establishing a relationship with a CPA early in your career can make future tax seasons much easier, as they’ll be familiar with your financial situation and tax history.

Post-graduation life is full of exciting possibilities, and by taking control of your finances early on, you can set yourself up for success. Whether it’s understanding your dependency status, maximizing tax credits, or saving for retirement, these steps will help you build a solid financial foundation.

If you have any questions or need professional assistance, CKH CPAs & Advisors are here to help. Contact us today for a free consultation and start your post-graduation journey on the right foot. You can also contact us at 1-770-495-9077 or email us at info@ckhgroup.com

The above article only intends to provide general financial information and is based on open-source facts, it is not designed to provide specific advice or recommendations for any individual. It does not give personalized tax, financial, or other business and professional advice. Before taking any form of action, you should consult a financial professional who understands your particular situation. CKH Group will not be held liable for any harm/errors/claims arising from the articles. Whilst every effort has been taken to ensure the accuracy of the contents, we will not be held accountable for any changes that are beyond our control.