Important 2025 Tax Dates

- February 10, 2025

- Posted by: CKH Group

- Categories: Financial Tips, Tax tips

Your Quick Guide to Important 2025 Tax Dates

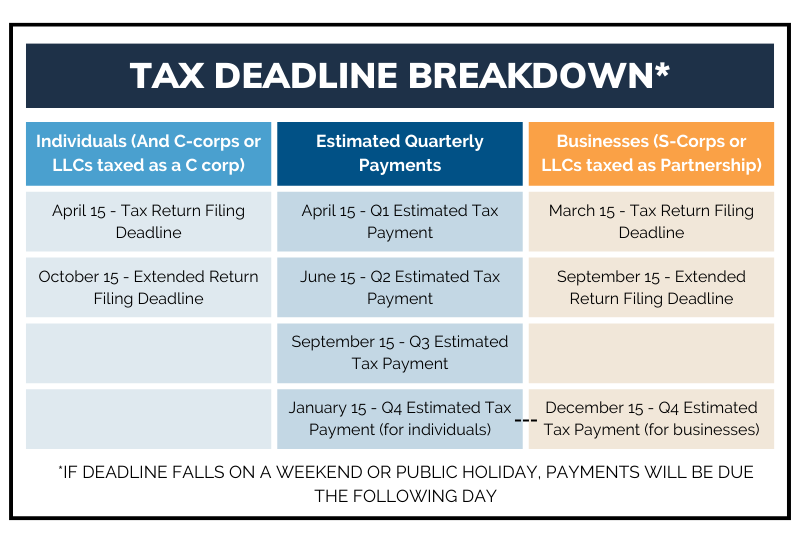

In the midst of tax season, keeping track of all the relevant 2025 tax dates and deadlines can be confusing. Refer to this quick guide to make sure you never miss an important deadline:

As stated above, if any of these deadlines fall on a Saturday, Sunday, or legal holiday, the deadline will be the following day. We have notated what the correct date for 2025 is below. *Keep in mind that these dates may be different for those affected by the deadline extensions due to Hurricane Helene.

As stated above, if any of these deadlines fall on a Saturday, Sunday, or legal holiday, the deadline will be the following day. We have notated what the correct date for 2025 is below. *Keep in mind that these dates may be different for those affected by the deadline extensions due to Hurricane Helene.

January 15, 2025

4th-Quarter 2024 Estimated Tax Payment Due

If you are self-employed or have other 4th-quarter income that requires you to pay quarterly estimated taxes, make sure to get them postmarked by this day.

January 27, 2025

IRS Begins Accepting Tax Returns

This is the earliest date in which the IRS will accept federal income returns for tax year 2024. Often marked as the ‘start’ of tax season, this deadline is usually when tax preparers typically gear up for filing, advising clients on necessary steps and documents.

January 31, 2025

Employers Must Mail Out W-2 Forms

Employers are mandated to mail out W-2 forms by January 31. Should you not receive your W-2 post this deadline, promptly reach out to your employer for clarification. Issues with changing mailing address may impact your receipt of mailed W-2 forms, so ensure your current and past employers are aware of any changes of address.

March 17, 2025

S-Corp & Partnership Tax Return Deadline

Entities structured as S-Corps or partnerships must adhere to this deadline for tax return filing. It’s imperative to ensure compliance, as failure to do so may result in penalties or legal ramifications.

S-Corp & Partnership Filing for Tax Extension Deadline

In addition, if your S-Corp or Partnership needed to file for an extension, this is the deadline to do so. Keep in mind that this extension only extends your filing deadline, and not your payment deadline.

April 15, 2025

Individual Tax Return Deadline

One of the most important tax dates of the year, this is the due date for filing individual tax returns and making tax payments. Make sure you have either applied for an extension, e-filed, or postmarked your individual tax returns by midnight.

1st-quarter Estimated Tax Payments 2025 Due

In addition, if you are self-employed or have other income that requires you to pay quarterly estimated taxes, be sure to get your 1040-ES Form postmarked by this date.

Individual Filing for Tax Extension Deadline

Lastly, should you need to file for an extension, the deadline to file this (usually Form 4868) is also on this date. Keep in mind that the deadline to pay, however, cannot be extended.

June 16, 2025

2nd-Quarter Estimated Tax Payments 2025 Due

If you are self-employed or have other income that requires you to pay quarterly estimated taxes, make sure your payment is postmarked by this date.

September 15, 2025

S-Corp And Partnership Tax Extension Deadline

If your business that is taxed as an S-Corp or Partnership filed a tax extension on your return, this is the deadline in which you must complete it and e-file or have it postmarked by.

3rd-Quarter Estimated Tax Payments 2025 Due

Additionally, if you are self-employed or have other income that requires you to pay quarterly estimated taxes, make sure your third-quarter payment is postmarked by this date.

October 15, 2025

Individual Tax Extension Deadline

If you had filed an extension on your individual tax return, you must complete it and e-file or have it postmarked by this date. You cannot file an additional extension to this- October 15 is your final day to file!

January 15, 2026

4th-Quarter 2025 Estimated Tax Payment Due

If you are self-employed or have other income that requires you to pay quarterly estimated taxes, make sure to get them postmarked by January 15, 2026.

Stay ahead of crucial tax deadlines to avoid penalties and ensure compliance with regulatory requirements. At CKH Group, we’re here to support you every step of the way on your financial journey. To learn more about what CKH Group you can book a free online consultation, or you can contact us directly at 1-770-495-9077 or email us at [email protected]

The above article only intends to provide general financial information and is based on open-source facts, it is not designed to provide specific advice or recommendations for any individual. It does not give personalized tax, financial, or other business and professional advice. Before taking any form of action, you should consult a financial professional who understands your particular situation. CKH Group will not be held liable for any harm/errors/claims arising from the articles. Whilst every effort has been taken to ensure the accuracy of the contents we will not be held accountable for any changes that are beyond our control.