Employee Retention Credit

- September 8, 2021

- Posted by: CKH Group

- Categories: COVID-19 Information, Current Events

Understanding the Employee Retention Credit (ERC): What You Need to Know in 2024

The Employee Retention Credit (ERC) was introduced in March 2020 as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This refundable tax credit was designed to support businesses during the economic uncertainty brought on by the COVID-19 pandemic, helping them retain employees on their payroll even during challenging times. While the ERC was a vital resource during its active period, it is essential to understand its history, how it evolved, and what it means for businesses in 2024.

The Evolution of the Employee Retention Credit

Initially, the ERC was created as a temporary measure to assist companies in keeping their workforce employed during the pandemic. However, as the situation evolved, so did the ERC. The requirements for eligibility were expanded, the maximum credit per employee was increased, and businesses were allowed to use the ERC in conjunction with the Paycheck Protection Program (PPP), which was another key support measure under the CARES Act.

In its original form in 2020, the ERC provided a maximum credit of up to $5,000 per employee for the year. This amount was later increased to $7,000 per employee per quarter for 2021, significantly boosting the potential financial support available to businesses. The ERC was available through September 30, 2021, after which it was phased out.

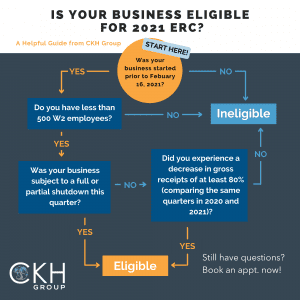

Eligibility for the ERC During Its Active Period

While the ERC is no longer available in 2024, understanding the eligibility criteria during its active period can provide insight into how businesses could benefit from such credits in future scenarios. For the 2021 tax year, the eligibility requirements were as follows:

- Business Operation: The company must have carried on a trade or business during 2020 or 2021.

- COVID-19 Impact: The business must have been either fully or partially suspended due to government orders related to COVID-19, or it must have experienced a significant decline in gross receipts. Specifically, the business needed to show a reduction in gross receipts of at least 20% compared to the same calendar quarter in 2019.

- Employee Count: Employers with more than 500 employees were eligible to claim the credit only on wages paid to employees who were not providing services. Smaller employers, with 500 or fewer employees, could claim the credit on wages paid to all employees, regardless of whether they were providing services or not.

- New Businesses: Employers who started their business after 2019 were also eligible to claim the credit under certain conditions, ensuring that newer companies could also benefit from this financial support.

Claiming the ERC: How It Worked

During its active period, businesses could claim the ERC by reducing their employment tax deposits up to the amount of the credit. This provided immediate access to the funds, which was crucial for maintaining cash flow. Employers reported their total qualified wages and related health insurance costs for each quarter on their quarterly employment tax returns (Form 941). The credit was taken against the employer’s share of Social Security tax, and any excess amount was refundable.

Retroactive Claims: Still Possible in 2024

Even though the ERC program officially ended on September 30, 2021, businesses can still apply for the Employee Retention Tax Credit (ERTC) retroactively. This means that although companies can no longer pay wages that would qualify to claim the ERC credit, they still have the opportunity to claim the credit for eligible wages paid during the active period of the ERC. This provision allows businesses that may have missed out on the ERC initially to still benefit from the credit by filing an amended return.

The End of the ERC and Its Impact

The ERC officially ended on September 30, 2021, marking the conclusion of this temporary but impactful program. While businesses can no longer claim the ERC on new wages in 2024, the credit played a crucial role in helping many companies navigate the financial challenges brought on by the pandemic.

Looking Ahead: Lessons from the ERC

The ERC serves as a valuable case study in how targeted tax credits can provide critical support during times of economic distress. While the ERC itself is no longer available, understanding its structure and benefits can help businesses prepare for future scenarios where similar credits might be introduced.

If you have any questions about the history of the ERC, the possibility of retroactive claims, or other tax credits that may be available to you in 2024, CKH Group is here to help. Our team of tax experts can guide you through the complexities of the tax system and ensure you’re making the most of any available credits. You can reach out here to book a free consultation or you can call us at 1-770-495-9077 or email us at [email protected]

The above article only intends to provide general financial information and is based on open source facts, it is not designed to provide specific advice or recommendations for any individual. It does not give personal tax, financial, or other business and professional advice. Before taking any form of action, you should consult a financial professional who understands your particular situation. CKH Group will not be held liable for any harm / errors / claims arising from the articles. Whilst every effort has been taken to ensure the accuracy of the contents we will not be held accountable for any changes that are beyond our control.