Transferable Clean Energy Investment Tax Credit Guide

- November 14, 2024

- Posted by: CKH Group

- Category: Financial Tips

Understanding Transferable Clean Energy Investment Tax Credits: A Comprehensive Guide

Transferable clean energy investment tax credits are an innovative mechanism designed to make clean energy investments more accessible and financially viable for a wider range of investors, from large corporations to smaller developers. These credits are part of a broader suite of general business credits, which include incentives for various activities that align with public policy goals, such as reducing greenhouse gas emissions, fostering innovation, and supporting affordable housing. This comprehensive guide, thoughtfully prepared by our subject matter experts, John Goss and Joely Goss, will explore every aspect of transferable clean energy investment tax credits, from their origins and mechanics to their strategic benefits and potential risks.

Overview of General Business Credits

General business credits allow businesses to reduce their corporate tax payments by claiming various credits that support specific activities, such as research and development, low-income housing, and energy efficiency. These credits serve as a tool for the federal government to encourage businesses to engage in behaviors that are beneficial to the economy and society at large. Among these are Investment Tax Credits (ITCs), which include:

- Manufacturing Credits: Support the development of energy-efficient products and technologies.

- Energy Efficiency Credits: Encourage investments in projects that reduce energy consumption, such as retrofitting buildings with modern insulation or upgrading to energy-efficient heating and cooling systems.

- Energy ITCs: Focus on renewable energy investments, including solar, wind, geothermal, and other sustainable energy sources that reduce reliance on fossil fuels.

To claim these credits, businesses must file specific forms, including Form 3800 for general business credits and Form 3468 for investment credits. This process ensures that businesses are accurately reporting their eligible activities and claiming the correct amount of credits.

Changes Brought by the Inflation Reduction Act (IRA) of 2022

The Inflation Reduction Act of 2022 was a landmark piece of legislation that significantly altered the landscape of federal energy tax credits. It introduced the concept of transferability, a transformative change that allows credits to be sold to third parties, thereby expanding access to these financial incentives beyond traditional tax equity investors.

The Past: Non-Transferable Energy ITCs

Prior to the IRA, energy ITCs were non-transferable, meaning they could only be claimed by the owners of the project or energy property. This restriction limited the usability of the credits to those entities with sufficient tax liability to absorb the credits. To make use of the credits, investors had to rely on complex and costly tax equity structures such as:

- Partnership Flips: A structure where tax equity investors receive most of the project’s tax benefits until a certain return is achieved, after which the ownership “flips” to the developer.

- Sale-Leasebacks: A developer sells the project to an investor and leases it back, allowing the investor to claim the tax credits while the developer continues to operate the project.

- Inverted Leases: A developer leases the project to a tax equity investor, who claims the credits and then leases the project back to the developer.

These structures were typically dominated by large banks, insurance companies, and other major financial institutions that had the tax appetite and financial expertise to navigate the complexities involved. As a result, the benefits of energy ITCs were largely out of reach for smaller developers and investors, particularly those focused on projects below the utility scale.

The Present: Transferability Mechanism

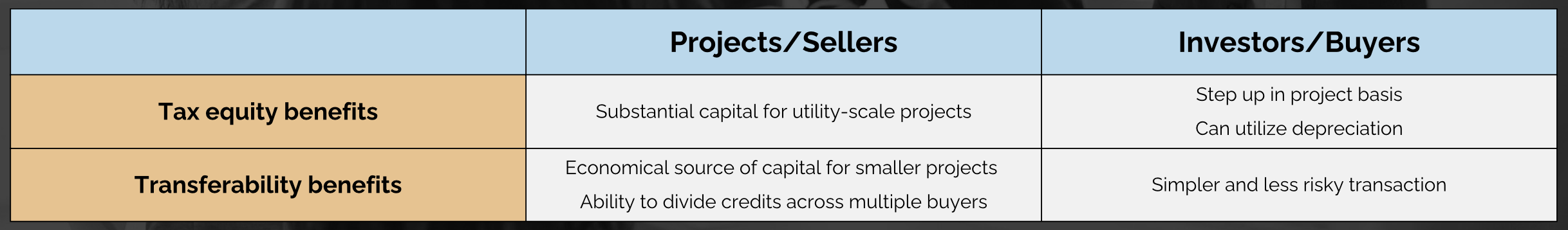

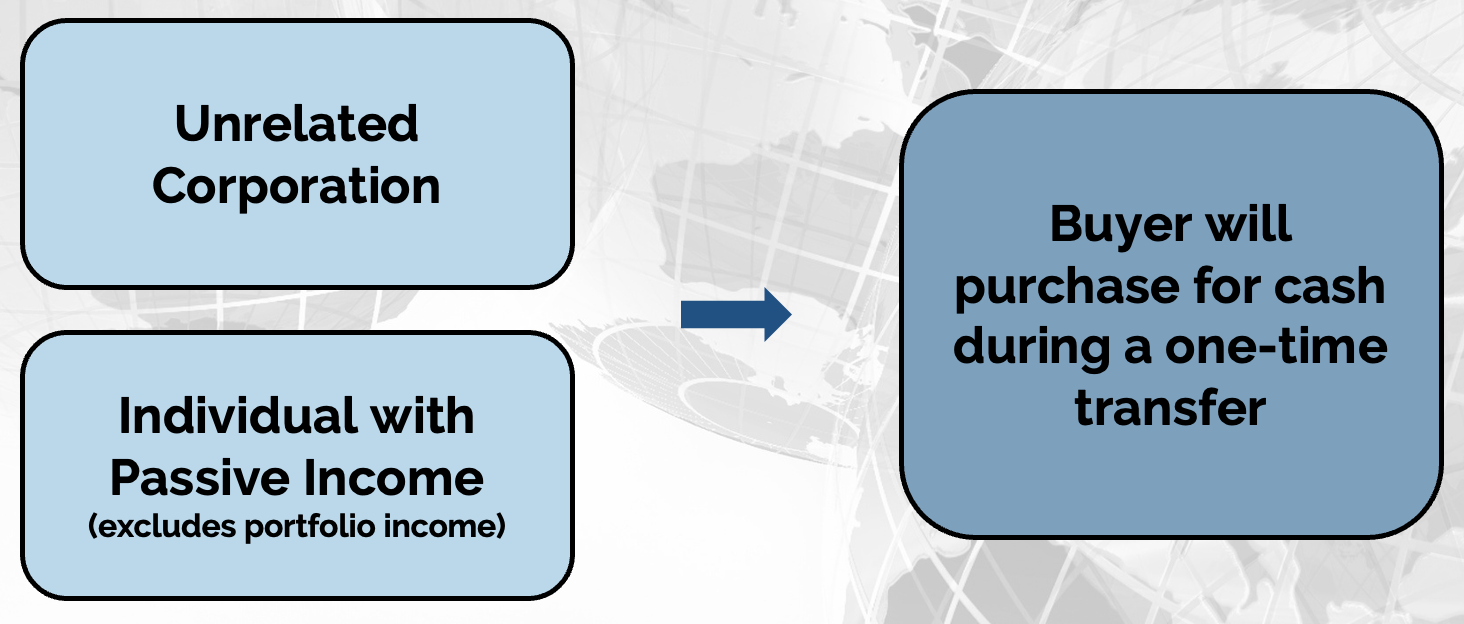

The introduction of the transferability mechanism under the IRA was a game-changer for the energy sector. For the first time, federal energy tax credits could be sold to unrelated third parties through a one-time transfer for cash, starting in 2023. This change democratized access to these credits, making it easier and more economical for smaller developers and investors to participate in the clean energy market. Key benefits of this mechanism include:

- Simplified Transactions: The transfer process is straightforward compared to traditional tax equity deals, which often require extensive legal, financial, and technical expertise.

- Reduced Risk: By allowing a simple sale of credits, the risk associated with structuring complex deals is significantly lowered, making the credits accessible to a broader range of investors.

- Broader Market Participation: The ability to sell credits opens the market to smaller developers who previously may have struggled to secure financing for their projects due to the complexities of traditional tax equity structures.

Why Transferability Was Introduced

The primary goal of introducing transferability was to expand access to clean energy incentives and support the growth of renewable energy projects across the United States. By making these credits transferable, the government aimed to:

- Increase Accessibility: Allowing credits to be sold to third parties makes them available to a broader range of investors, including those who may not have the tax liability needed to utilize non-transferable credits effectively.

- Simplify Financing: Transferability simplifies the financing process for renewable energy projects, reducing the need for complex and expensive tax equity structures that have traditionally been a barrier to entry for smaller developers.

- Support Market Expansion: The ability to sell credits provides a new, straightforward avenue for raising capital, which can help drive investment in emerging and less mature clean energy technologies.

How Transferable Energy Investment Tax Credits Work

Federal transferable energy tax credits function as a type of general business credit that can be sold to third parties, allowing investors to acquire these credits at a discount. This mechanism provides corporations and eligible individuals (with passive income) an opportunity to reduce their effective tax rates and improve cash flow without the need for complex financial structures.

Who Can Benefit?

- Corporations with Federal Tax Liabilities: These companies can use the credits to offset a portion of their tax liability, providing immediate cash flow benefits and reducing their effective tax rate.

- Individuals and Flow-Through Entities with Passive Income:Entities with passive income tax liabilities (excluding portfolio income) can also benefit from purchasing these credits, applying them against their tax liabilities.

Immediate Benefits Against Estimated Payments: Credits can be applied to reduce estimated tax payments, offering immediate financial relief.

Pricing of Transferable Credits

Typically, these credits are sold at a discount ranging from $0.94 to $0.96 per $1.00 of tax credit. For example, settling a $10 million tax liability for $9.4 million saves $600,000 in cash, offering a tax-free discount. The price of credits can vary based on market conditions, the credit quality, and the timing of the transfer.

How You Can Benefit from Transferable Energy Tax Credits

If your company has a federal tax liability, it can benefit from purchasing energy tax credits at a discount, thereby deferring estimated tax payments. These credits can be applied in combination with other general business credits against 75% of your company’s tax liability each year. Excess energy tax credits can be:

- Carried Back: Up to 3 years, allowing companies to offset past tax liabilities.

- Carried Forward: Up to 22 years, providing flexibility to apply credits against future tax liabilities.

This flexibility allows companies to strategically manage their tax positions across multiple years, optimizing their financial outcomes and providing a buffer against fluctuations in profitability.

Example Transaction and Savings

Listed below are a handful of examples of savings and benefits from purchasing these energy tax credits.

Example 1: Immediate Cash Savings

A company has $13.4 million in tax liabilities, of which 75% (or $10 million) can be offset using federal general business credits. By purchasing $10 million of energy tax credits for $9.4 million, the company saves $600,000 in cash. This example illustrates the immediate cash flow benefit of acquiring transferable credits, which can be a critical advantage for companies looking to manage their tax obligations efficiently.

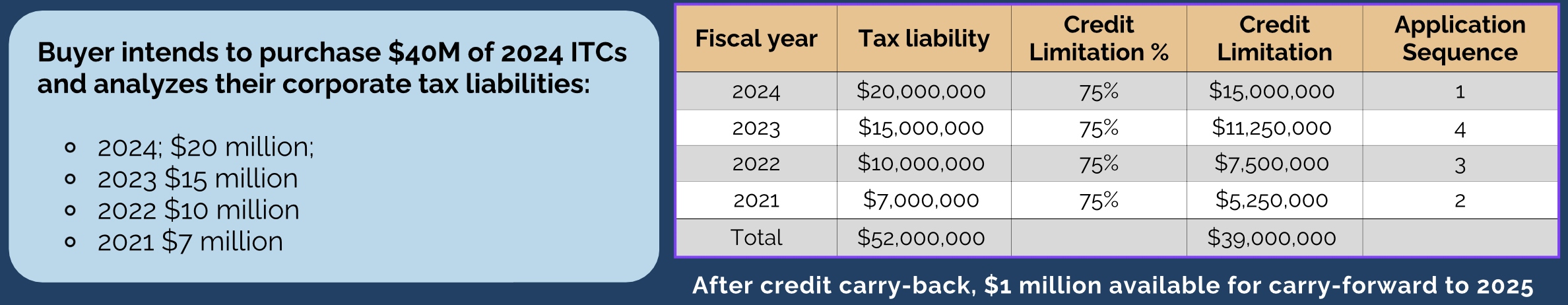

Example 2: Multi-Year Credit Application

A company plans to utilize a $40 million energy ITC over four years, analyzing its corporate tax liabilities as follows:

With a credit discount of 6%, the company saves $2.34 million ($39 million x 0.06) in taxes over the four years. This multi-year application strategy demonstrates how transferable credits can be used to optimize tax outcomes across multiple fiscal years, providing ongoing benefits and financial stability.

Example 3: Benefits for Individuals and Flow-Through Entities with Passive Income

John, an investor with significant passive income from multiple rental properties, has a passive income tax liability of $500,000 for the year. John purchases transferable energy tax credits worth $375,000 at a discount rate of $0.90 per $1.00 of credit. By doing so, John pays $337,500 for the credits, saving $37,500.

John applies these credits to his passive income tax liability, reducing his overall tax burden. This approach provides him with a substantial tax saving and allows him to directly support the growth of renewable energy projects, aligning his investments with sustainable and environmentally responsible practices.

This example highlights how individuals and flow-through entities with passive income can leverage transferable credits to reduce their tax liabilities, optimize their financial strategies, and support clean energy initiatives.

The 8-Step Transfer Process for Energy ITCs under Sec. 48 & 48E

Successfully navigating the transfer of energy tax credits involves a structured 8-step process:

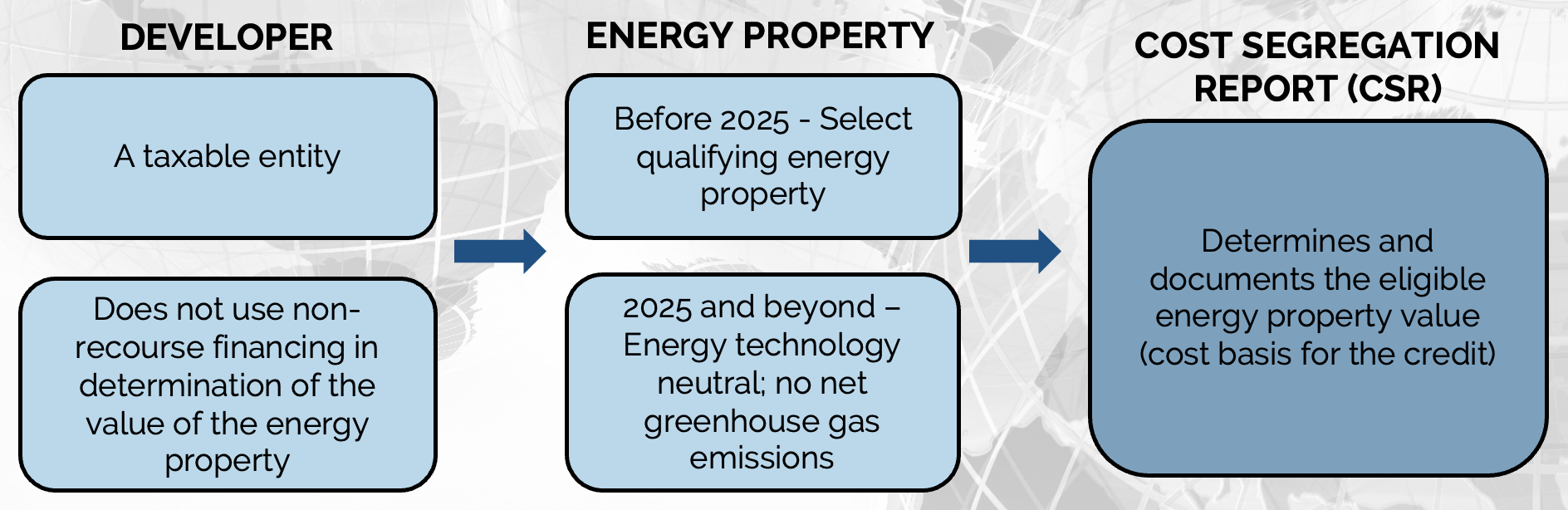

1. Valuation of Energy Property

The developer must determine the value of the energy property, ensuring they are a taxable entity and not using non-recourse financing. The value of the energy property (and the cost basis of the investment credit) is determined and documented through a cost segregation report (CSR), which segregates out eligible project costs and validates their eligibility.

If the energy property is constructed and placed into service before 2025, the developer must look to Sec. 48, which only applies to certain technologies. If the energy property is constructed and placed into service in 2025 or later, the developer must look to Sec. 48E, which does not discriminate based on technology type, but all projects must have net zero greenhouse gas emissions to qualify.

2. Quantification of Qualifying Credits

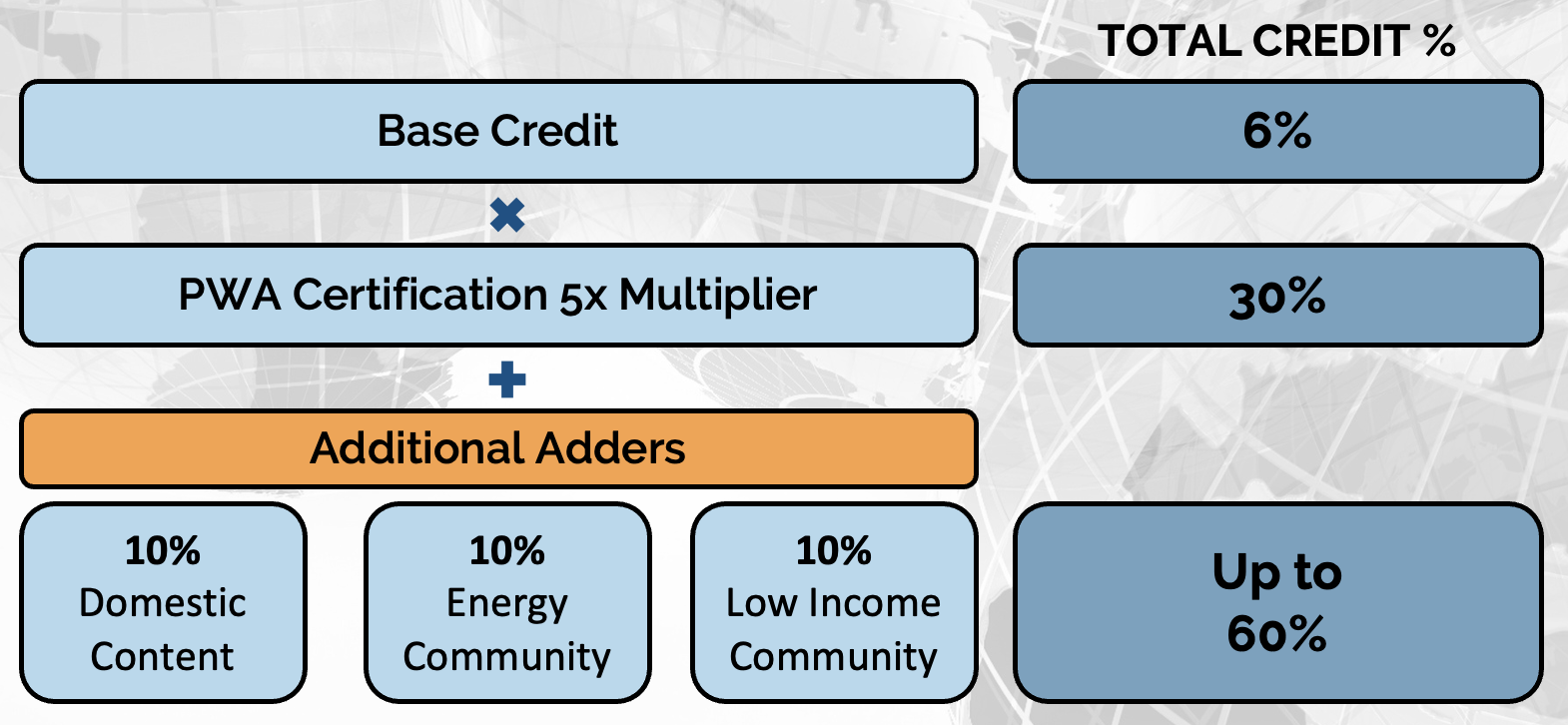

The developer determines the eligible cost basis under Section 48 or Section 48E. The base credit is 6% of the qualifying investment (or eligible cost basis). This base credit may be eligible for various enhancements, such as a 5x multiplier (increasing the credit to 30%) if the project meets prevailing wage and apprenticeship (PWA) requirements during construction. An energy property may also qualify for additional 2% (10%, if PWA is met) adders that increase the credit up to 60% of the qualifying investment. The available adders are:

- Domestic Content: applicable to projects constructed with certain percentages of steel, iron or manufactured products that were mined, produced or manufactured in the United States,

- Energy Community: applicable to projects located in specific census tracts, and

- Low Income Community: applicable to projects located in specific census tracts or as part of affordable housing developments. This adder is limited and must be applied for through the Department of Energy’s Office of Economic Impact and Diversity.

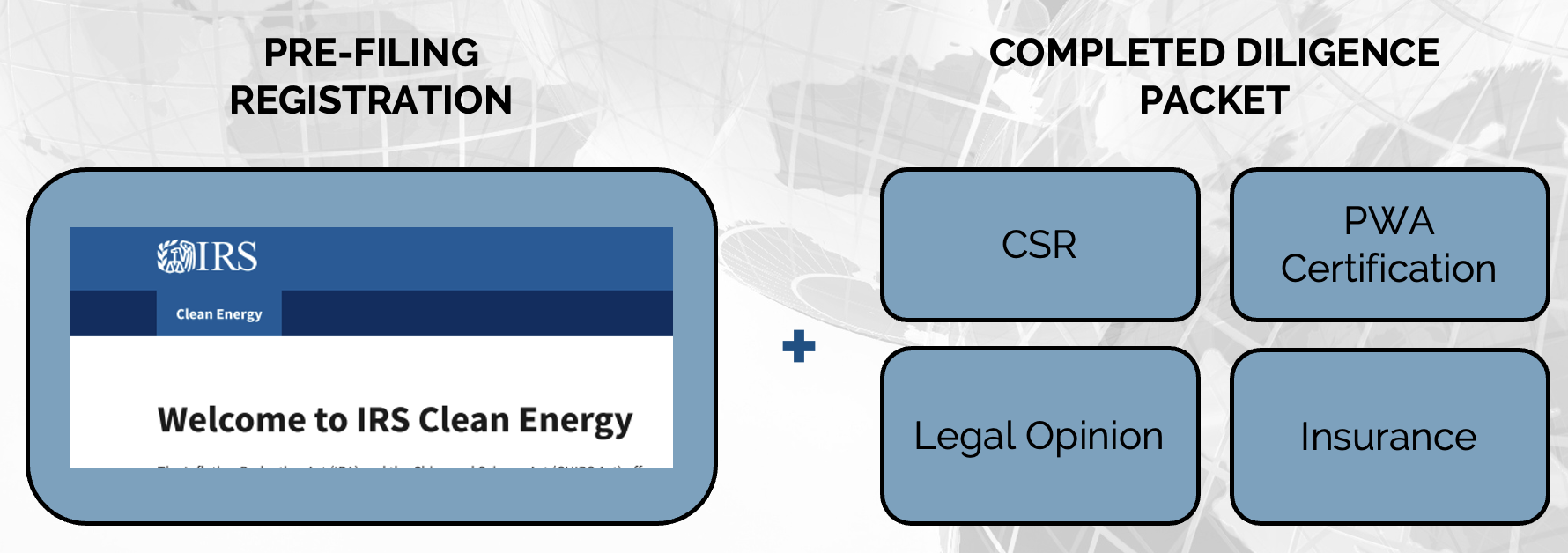

3. IRS Project Registration

The developer must register their energy project with the IRS and receive a registration number. This step is essential to claim the energy tax credit as this registration number is used later during tax return filing. When a credit is transferred, both the developer (seller) and the buyer must include this number in their tax return filing. At this point, the developer should have a completed diligence packet substantiating their eligibility for energy tax credits.

4. Introduction to Buyer

The buyer, an unrelated corporation or individual with passive income, is introduced to the seller (developer), who presents their completed diligence package for the buyer’s review.

5. Buyer Due Diligence

The buyer reviews the sellers completed diligence packet. This includes reviewing cost segregation studies, obtaining legal opinions, and securing insurance contracts as needed. Due diligence ensures the credit’s legitimacy and helps mitigate risks associated with the transaction.

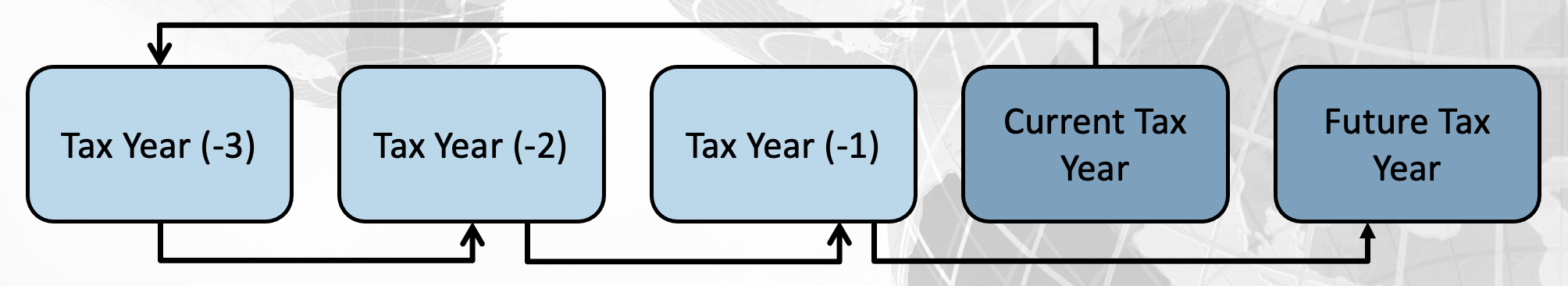

6. Determination of Applicable Tax Year

The buyer determines which tax year to apply the credit against. Credits must first be applied to the tax year in which they were claimed by the developer (seller). If there is excess credit value, the credits are then carried back sequentially to three years before the current tax year, then two years before, then one year before. If there is still excess credit after the carry back, then credits may be claimed in future years.

7. Tax Credit Transfer Agreement

A formal agreement is made, and the transfer election statement is prepared, accompanied by the payment for credits before tax returns are filed. This step formalizes the transfer and ensures both parties meet their legal and tax obligations.

8. Reporting and Tax Filing

The final and most important step: accurate tax filing to receive your savings. Using the registration number assigned by the IRS, the buyer files Form 3800 with their tax return, while the seller files Forms 3468 and 3800. Proper reporting ensures compliance with IRS requirements and facilitates the smooth application of the credits.

Risk Mitigation Strategies for Transferable Energy ITCs

Transferring energy tax credits can offer significant financial benefits, but it also involves inherent risks that need to be carefully managed. Understanding these risks and implementing robust mitigation strategies are essential to protect all parties involved in the transaction.

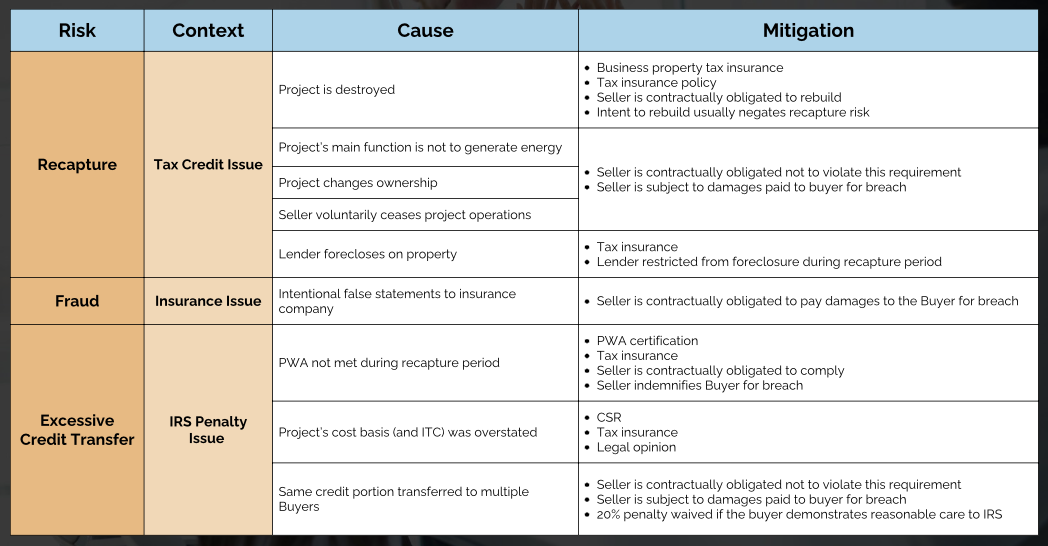

Here is an in-depth look at the key risks, their causes, and recommended mitigation strategies:

1. Risk: Recapture

Context: Recapture refers to the IRS reclaiming previously issued tax credits if the underlying conditions or requirements of the credit are not maintained over a specified period (5 years for energy ITCs under Sec 48 and Sec. 48E). Because this risk falls on whoever claims the credits on their tax return, recapture can have severe financial implications for the buyer of the credits.

Causes and Mitigations:

- Cause: Project is Destroyed

- Mitigation: To safeguard against this risk, securing business property insurance that covers tax credits specifically can provide a financial buffer. Additionally, a tax insurance policy can further protect against the loss of credits due to project destruction. Contracts should also obligate the seller to rebuild the project promptly. In many cases, an intent to rebuild the project, if clearly demonstrated, can negate the recapture risk, providing reassurance that the credits will remain valid.

- Cause: Project’s Main Function is Not to Generate Energy, Project Changes Ownership, or Seller Voluntarily Ceases Project Operations

- Mitigation: The seller should be contractually obligated to ensure that the project continues to operate primarily as an energy-generating facility. Agreements can include clauses that penalize the seller for breaching these obligations, including payment of damages to the buyer. These contractual safeguards enforce compliance and reduce the likelihood of project repurposing or operational cessation that could trigger recapture.

- Cause: Lender Forecloses on Property

- Mitigation: To mitigate the risk of foreclosure, tax insurance can be used to cover potential recapture events linked to financial distress or lender actions. Additionally, legal agreements can restrict lenders from foreclosing on the property during the critical recapture period, ensuring that the credits remain secure until the required conditions are met.

2. Risk: Fraud

Context: Fraud in the context of insurance involves deliberate misstatements or omissions that can lead to denial of coverage or financial penalties.

Cause and Mitigation:

- Cause: Intentional False Statements to Insurance Company

- Mitigation: To address this risk, contracts should clearly state that the seller is responsible for any damages arising from fraudulent actions. This includes making false statements to insurance companies. By holding the seller liable for breaches of integrity, buyers can ensure that all representations made to insurance providers are accurate and truthful, thus maintaining the integrity of the insurance coverage.

3. Risk: Excessive Credit Transfer

Context: Excessive credit transfer occurs when more credits are transferred than are legally permissible, leading to potential IRS penalties.

Causes and Mitigations:

- Cause: PWA Not Met During Recapture Period

- Mitigation: Adhering to the prevailing wage and apprenticeship (PWA) requirements is crucial for maintaining the full value of the credits. Certification that these standards are met, backed by tax insurance, provides assurance that the credits will not be subject to recapture. Contractual obligations can also mandate compliance with PWA requirements, and indemnification clauses can hold the seller responsible for any breaches that lead to penalties.

- Cause: Project’s Cost Basis (and ITC) Was Overstated

- Mitigation: To prevent overstatement of the project’s cost basis, which can inflate the value of the ITC, a thorough cost segregation report (CSR) should be prepared. Tax insurance can cover discrepancies in reported cost basis, and obtaining a legal opinion can add an additional layer of verification. These steps help ensure that the project’s financial representations are accurate and defensible.

- Cause: Same Credit Portion Transferred to Multiple Buyers

- Mitigation: A critical safeguard against multiple transfers of the same credit portion is a clear contractual prohibition against such actions. If a seller violates this condition, they should be liable for damages to the affected buyers. The IRS may waive the 20% penalty if the buyer can demonstrate that they exercised reasonable care, underscoring the importance of rigorous due diligence and compliance verification throughout the transfer process.

Market Outlook and CKH Group’s Role

The transferability mechanism has revolutionized the energy tax credit market, making it accessible to a broader range of investors and encouraging the growth of clean energy projects. Since the credits became transferable in late 2023, the market has surged, with expectations of $20-$25 billion in transferable credit purchases in 2024 alone.

The transferability mechanism has revolutionized the energy tax credit market, making it accessible to a broader range of investors and encouraging the growth of clean energy projects. Since the credits became transferable in late 2023, the market has surged, with expectations of $20-$25 billion in transferable credit purchases in 2024 alone.

CKH Group’s Offerings

CKH Group, as an experienced advisor in this field, offers invaluable support to buyers by sourcing, vetting, and facilitating the transfer of energy tax credits. Our team of CPAs ensures that all transactions are compliant and optimized, providing clients with tailored solutions that maximize their tax savings and minimize risks. Our services include:

- Credit Sourcing and Vetting: Identifying high-quality credits and ensuring they meet all eligibility and compliance requirements.

- Transaction Support: Guiding clients through the entire transfer process, including due diligence, legal review, and document preparation.

- Risk Mitigation: Advising on indemnification options, tax insurance, and other strategies to protect buyers from potential risks associated with credit transfers.

For more information on how CKH Group can assist with your energy tax credit needs, contact us at 1-770-495-9077 or email us at info@ckhgroup.com. You can also download a quick brochure on Transferable Clean Energy Tax Credits here.

The above article only intends to provide general financial information and is based on open-source facts, it is not designed to provide specific advice or recommendations for any individual. It does not give personalized tax, financial, or other business and professional advice. Before taking any form of action, you should consult a financial professional who understands your particular situation. CKH Group will not be held liable for any harm/errors/claims arising from the articles. Whilst every effort has been taken to ensure the accuracy of the contents, we will not be held accountable for any changes that are beyond our control.