Claiming a Dependent

- October 13, 2021

- Posted by: CKH Group

- Categories: Financial Tips, Tax tips

Navigating the Process of Claiming a Dependent on Your Taxes

Claiming a dependent on your tax return can be a confusing process, but understanding the basics can unlock valuable tax benefits. This guide will help you understand what it means to claim a dependent and how to determine if someone qualifies as a dependent on your taxes.

What Does It Mean to Claim a Dependent?

A tax dependent is typically a child or a relative who meets specific criteria that allow you to claim them on your tax return. Claiming a dependent can provide several tax advantages, including eligibility for tax credits like the Child Tax Credit, various deductions, and even a more favorable filing status such as Head of Household.

These benefits can lead to significant savings on your tax bill, making it essential to understand who qualifies as a dependent.

Key Steps to Determine Eligibility

Before diving into the specifics of claiming a dependent, it’s important to verify some initial qualifications:

- Citizenship and Residency: The person you wish to claim must be a U.S. citizen, U.S. national, or a resident of the United States.

- Uniqueness: The dependent cannot be claimed by anyone else.

- Marital Status: The person you are claiming should be unmarried and not filing a joint tax return with someone else.

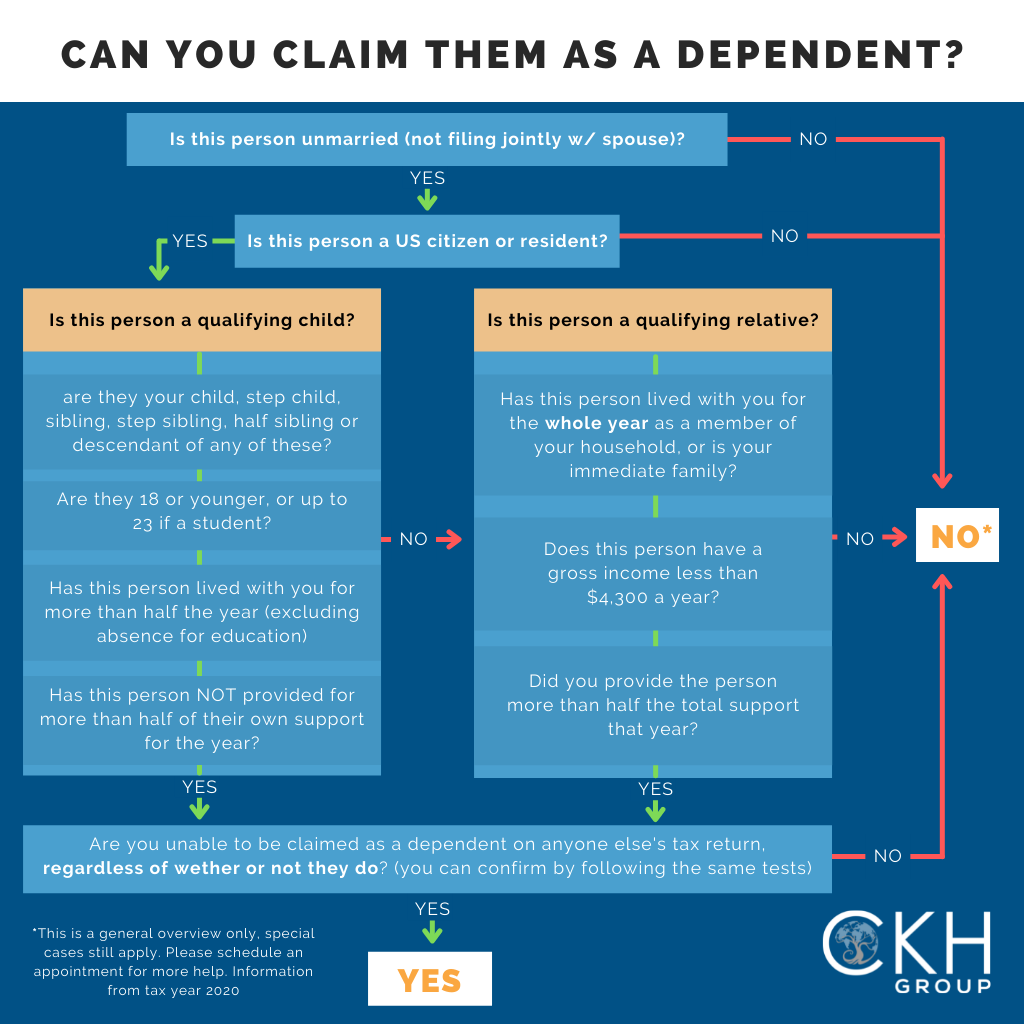

If the person meets these basic requirements, the next step is to identify how they relate to you, as this will determine whether they fall under the category of a “qualifying child” or a “qualifying relative.” This chart below gives a good overview of how to determine this:

Claiming a Qualifying Child

A qualifying child is generally your biological child, stepchild, sibling, half-sibling, or a descendant of any of these. To claim someone as a qualifying child, they must meet the following criteria:

- Age: The child must be 18 years old or younger at the end of the tax year, or a full-time student under the age of 24 who attended school for at least five months of the year.

- Residency: The child must have lived with you for more than half of the tax year. Temporary absences, such as for schooling, are typically excluded.

- Financial Support: You must have provided more than half of the child’s financial support during the year.

In situations of divorce or separation, the parent with primary custody usually has the right to claim the child, unless otherwise agreed upon in a custody arrangement.

Claiming a Qualifying Relative

If the individual does not meet the criteria for a qualifying child, they may still be considered a qualifying relative. The criteria for claiming a qualifying relative include:

- Residency: The person must have lived with you for the entire year and be considered a member of your household, though they do not need to be directly related to you.

- Income: The individual’s gross income must be less than $4,300 for the tax year.

- Financial Support: You must have provided more than half of their total financial support during the year.

Important Considerations and Restrictions

Before you claim a dependent, it’s crucial to ensure that no one else has claimed you as a dependent. If you are claimed as a dependent on someone else’s tax return, you are not eligible to claim any dependents of your own. Additionally, certain individuals cannot be claimed as dependents, including those who are not U.S. citizens (with some exceptions) and those who are employed by you.

It’s also worth noting that if the person you’re trying to claim does not meet all the IRS guidelines for a qualifying dependent, you may not be able to claim them. This includes scenarios where the person is filing a joint tax return, earning too much income, or not living with you for the required amount of time.

Get Expert Assistance

Claiming a dependent can have a significant impact on your tax return, offering you access to valuable tax credits and deductions. However, the process can be complex, and it’s important to ensure you meet all the IRS requirements. For personalized guidance and to ensure you’re maximizing your tax benefits, consider reaching out to CKH Group for a free consultation.

Our experts can help you navigate the intricacies of claiming a dependent and provide you with the support you need for a successful tax season. If you have any questions or concerns about claiming a dependent, CKH Group is here to help you! You can reach out here to book a free consultation or you can call us at 1-770-495-9077 or email us at info@ckhgroup.com

The above article only intends to provide general financial information and is based on open source facts, it is not designed to provide specific advice or recommendations for any individual. It does not give personal tax, financial, or other business and professional advice. Before taking any form of action, you should consult a financial professional who understands your particular situation. CKH Group will not be held liable for any harm / errors / claims arising from the articles. Whilst every effort has been taken to ensure the accuracy of the contents we will not be held accountable for any changes that are beyond our control.