Audit vs. Review vs. Compilation: Simplified

- June 17, 2024

- Posted by: CKH Group

- Category: Financial Tips

Audit vs. Review vs. Compilation: A Complete Breakdown

In the world of finance, it is crucial to understand the varying types of attestation services that can benefit the growth and development of your business, nonprofit organization, or government entity; but what is the difference between an audit vs. review vs. compilation? Each of these services offers a different level of assurance or confidence to investors, but also requires varying amounts of time and effort to perform. Let’s delve into the differences between audit, review, and compilation engagements, to gain insights into when each service is appropriate and the level of confidence that each provides.

What is an Audit?

An audit represents a comprehensive examination of an organization’s financial records, transactions, and internal controls by an independent certified public accountant (CPA) or a team of auditors. The primary objective of an audit is to provide reasonable assurance that the financial statements are free from material misstatements and comply with the Generally Accepted Accounting Principles (GAAP), International Financial Reporting Standards (IFRS) or any other acceptable accounting framework applied by the entity, this means that the auditor confirms that they’ve checked the financial statements thoroughly and believe they are accurate. Audits are typically required for publicly traded companies and certain private entities to ensure transparency and accountability for shareholders, investors, and regulatory bodies.

During an audit, CPAs and auditors perform extensive reconciliations and testing of the accounting records and relevant supporting evidence. They evaluate the internal control systems to identify any potential weaknesses that could lead to potential errors or fraud. At the end of the engagement, the CPA provide their professional opinion on whether the financial statements are accurate and complete and that it is fairly presented in accordance with the applicable financial reporting framework.

Determining Audit Requirements

The decision to undergo an audit or a review is often driven by various factors, including legal requirements, investor expectations, and the specific needs of the organization. Here are some scenarios when an audit may be required:

Legal Requirements:

Stakeholder Expectations:

Risk Assessment:

Mergers and Acquisitions:

Compliance and Regulatory Requirements:

Certain industries, such as finance, healthcare, or manufacturing, may be subject to specific regulatory standards that require regular audits or reviews to ensure compliance with industry-specific regulations and guidelines.

Funding and Grants:

Organizations applying for grants or government funding may be required to provide audited financial statements or undergo a financial review as part of the application process.

Internal Management Needs:

Management may opt for regular internal audits or reviews to evaluate the efficiency and effectiveness of their operations, identify areas for improvement, and ensure the integrity of financial reporting.

What is a Review?

A financial statement review entails a less intensive assessment of financial statements compared to an audit. It involves analytical procedures and inquiries by a CPA to determine whether any material modifications are needed to be made to the financial statements for them comply with the applicable framework. While a review provides limited assurance, it is considered a cost-effective option for organizations that require a moderate level of assurance for their financial statements.

During a review, the required procedures are performed to assess the reasonability of the financial information. However, unlike audits, they do not perform extensive testing of the accounting records or evaluate the internal control systems. The objective is to provide a moderate level of assurance that the financial statements are free from material misstatements.

What is a Compilation?

Comparing Audit, Review, and Compilation

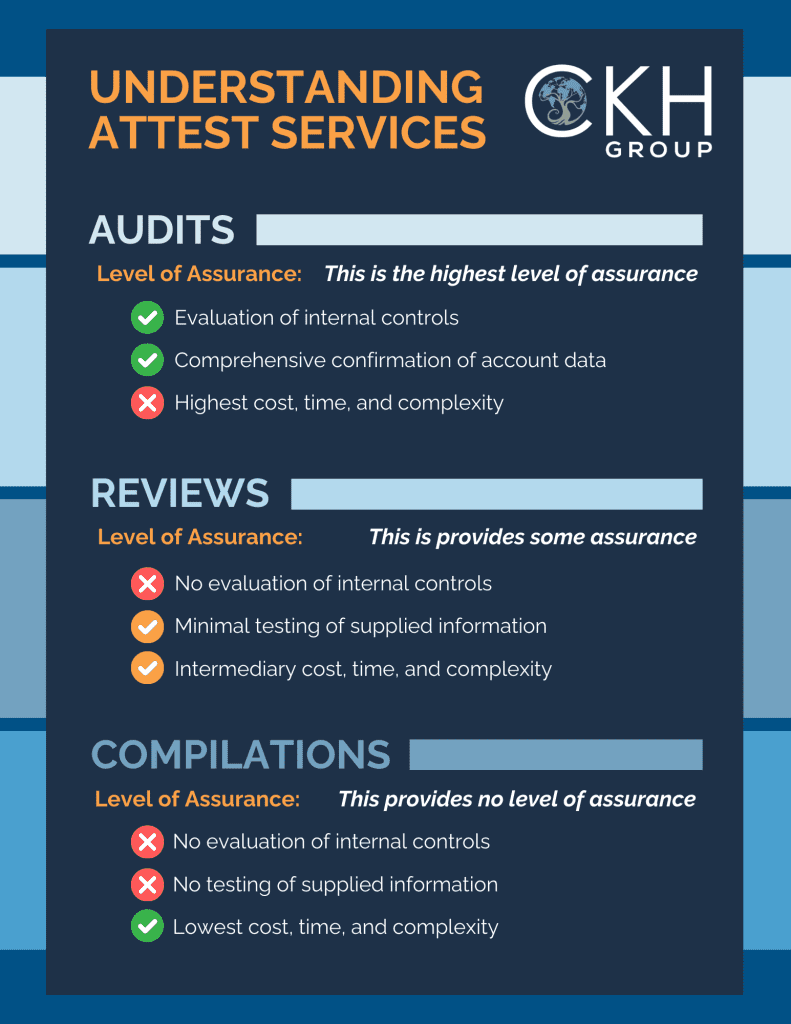

Now that we’ve clarified the differences between audit, review, and compilation engagements, the key differences can easily be broken down as follows:

Assurance level

Assurance level

Audits provide the highest level of assurance, followed by review engagements offering a moderate level of assurance then lastly compilation engagements provide no assurance. The level of assurance generally corresponds to the complexity, time and cost involved.

Completion Hours

Audits are the most time-intensive, followed by review engagements and then compilation engagements. The level of detail and procedures required determine the time needed for completion.

Cost

Audits generally incur the highest costs due to their thorough nature, followed by review engagements and compilation engagements, which are less costly. The cost of review engagements is generally between the costs of audit and compilation engagements, given the limited procedures performed.

Dependency and Involvement of Management

The auditor initiates each service by examining the account balances furnished by management. Auditing involves thorough validation of the information, whereas a review involves minimal testing, and a compilation primarily relies on the information provided by management. Management will be responsible for providing the auditor with financial information and documentation based on the size and complexity of their organization.

Test of Internal Controls

Audits include an assessment of certain internal controls within the company, whereas reviews and compilations do not incorporate any form of testing.

Understanding Agreed-Upon Procedure Engagements

In addition to the three engagements which have been discussed, clients can opt for agreed-upon procedure engagements, allowing them to request specific procedures to be performed as a service, which can be beneficial for addressing particular needs. This is a great option for clients who only need one specific item completed or may not have the expertise to complete certain procedures.

Conclusion

Understanding the differences between audit, review, and compilation engagements is vital for maintaining transparency, building trust with stakeholders, and ensuring compliance with regulatory requirements. By selecting the most appropriate service based on your needs and requirements, organizations can improve their financial reporting practices, save resources, and uphold credibility in the market. Whether aiming for transparency, compliance, or risk mitigation, choosing the right service is crucial for achieving organizational goals.

The above article only intends to provide general financial information and is based on open-source facts, it is not designed to provide specific advice or recommendations for any individual. It does not give personalized tax, financial, or other business and professional advice. Before taking any form of action, you should consult a financial professional who understands your particular situation. CKH Group will not be held liable for any harm/errors/claims arising from the articles. Whilst every effort has been taken to ensure the accuracy of the contents we will not be held accountable for any changes that are beyond our control.

Book a FREE Introductory Consultation

Secure your future today in person or online.

Assurance level

Assurance level